The Stages of Foreclosure

May 16, 2023

Foreclosure is a process that allows a lender to recover what a client owes on a defaulted loan. The process allows the lender to take ownership or sell a property. If you face foreclosure, you must understand how the process works. Foreclosure may not necessarily mean ending home ownership, but the process could have other implications about how you will live in your home. Below, we explain the phases of the foreclosure process.

The first stage of foreclosure involves defaulting on payments. Usually, homeowners begin to default after a major life event, such as death or loss of income. Lenders will try to work with you in such events to ensure you can keep your home or property.

The lender will contact you about being delinquent after 36 days of payment delay. They will provide written notice by day 45. The notice will include information on any repayment options you may use to remedy the situation. However, if it is impossible, the lender may file for foreclosure.

Usually, the lender will resort to foreclosure if you are more than 120 days behind on mortgage payments. A court process will begin if, within 30 days of the filing, the property owner does not redeem the property.

The notice of default will go to the defaulter's last known address and will include details such as the amount owed and when it should be paid. If you do not take any steps to remedy the situation, the foreclosure process moves to the next phase, the notice of sale.

This phase involves the lender setting a public sale date. The sale date is not usually immediate. During this time, a homeowner can try to save their home or property. Other options worth exploring include short sales, pre-foreclosure counseling, or bankruptcy.

The notice of sale is sent to all the borrowers obligated to pay the debt. The notice is also posted in the county's courthouse and filed with the county clerk. The details in the notice include the location, time, and date of the sale. If the owner is a military service member, they should notify the sender of their military status.

It's important to note that the sale date is not immediate as the lender must complete the entire foreclosure process, obtain a final judgment of foreclosure and the court will then set a sale date.

The sale of the property will happen through auction. Creditors can place their bid on your property at a foreclosure auction. If a bid is higher than the amount you owe on the mortgage, the bank will take ownership of the house.

Sometimes, the lender or bank may need to buy back the property for lack of buyer interest. This type of property is known as bank-owned or real estate property. The bank will attempt to directly sell this property to buyers, sometimes on their website.

At this point, you are forced to leave the property, which is then sold to the company or person who won the bid. If the former homeowner refuses to leave the property, a marshal or sheriff may forcefully evict them from the property.

The property owner will be given a notice before eviction and given the option of renting or paying back the mortgage before eviction. Note that some states have laws that protect homeowners whose homes have faced foreclosures. So, the homeowner could benefit from contacting the local housing agency to understand their options.

In the state of Florida, the clerk of court will issue a title to the highest bidder at the foreclosure sale. After 10 days, the title will expire without any objection or appeal being filed.

No foreclosure situation is like the next. Therefore, to protect your interests, you need to work with an experienced foreclosure attorney. An attorney helps your case by helping you understand your rights and options throughout the process. Reach out to us at Ozment Law for legal guidance.

Stage 1: Default of Payment

The first stage of foreclosure involves defaulting on payments. Usually, homeowners begin to default after a major life event, such as death or loss of income. Lenders will try to work with you in such events to ensure you can keep your home or property.

The lender will contact you about being delinquent after 36 days of payment delay. They will provide written notice by day 45. The notice will include information on any repayment options you may use to remedy the situation. However, if it is impossible, the lender may file for foreclosure.

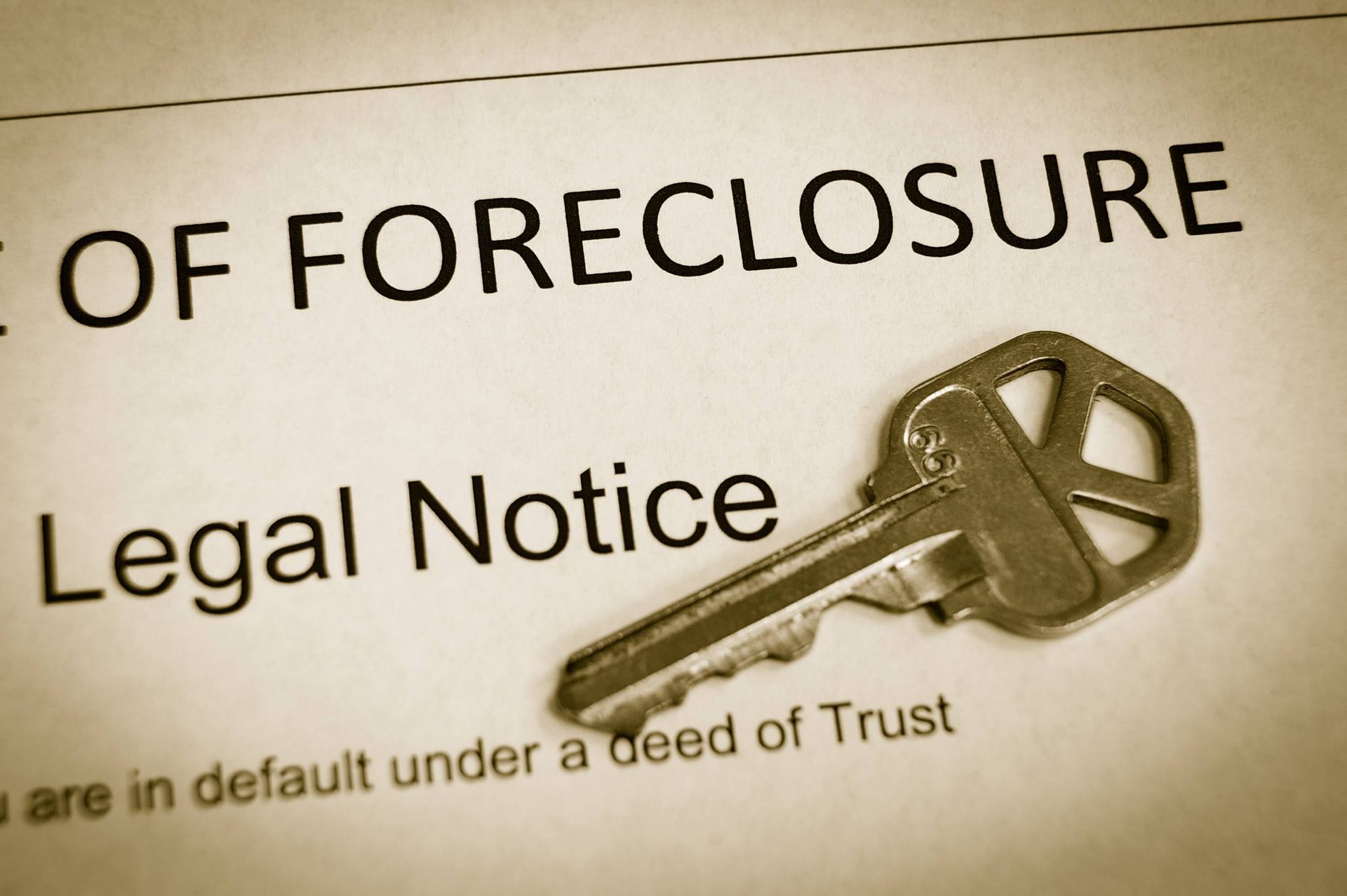

Stage 2: Notice of Default

Usually, the lender will resort to foreclosure if you are more than 120 days behind on mortgage payments. A court process will begin if, within 30 days of the filing, the property owner does not redeem the property.

The notice of default will go to the defaulter's last known address and will include details such as the amount owed and when it should be paid. If you do not take any steps to remedy the situation, the foreclosure process moves to the next phase, the notice of sale.

Stage 3: Notice of Sale

This phase involves the lender setting a public sale date. The sale date is not usually immediate. During this time, a homeowner can try to save their home or property. Other options worth exploring include short sales, pre-foreclosure counseling, or bankruptcy.

The notice of sale is sent to all the borrowers obligated to pay the debt. The notice is also posted in the county's courthouse and filed with the county clerk. The details in the notice include the location, time, and date of the sale. If the owner is a military service member, they should notify the sender of their military status.

It's important to note that the sale date is not immediate as the lender must complete the entire foreclosure process, obtain a final judgment of foreclosure and the court will then set a sale date.

Stage 4: Foreclosure Sale

The sale of the property will happen through auction. Creditors can place their bid on your property at a foreclosure auction. If a bid is higher than the amount you owe on the mortgage, the bank will take ownership of the house.

Sometimes, the lender or bank may need to buy back the property for lack of buyer interest. This type of property is known as bank-owned or real estate property. The bank will attempt to directly sell this property to buyers, sometimes on their website.

Stage 5: Eviction

At this point, you are forced to leave the property, which is then sold to the company or person who won the bid. If the former homeowner refuses to leave the property, a marshal or sheriff may forcefully evict them from the property.

The property owner will be given a notice before eviction and given the option of renting or paying back the mortgage before eviction. Note that some states have laws that protect homeowners whose homes have faced foreclosures. So, the homeowner could benefit from contacting the local housing agency to understand their options.

In the state of Florida, the clerk of court will issue a title to the highest bidder at the foreclosure sale. After 10 days, the title will expire without any objection or appeal being filed.

No foreclosure situation is like the next. Therefore, to protect your interests, you need to work with an experienced foreclosure attorney. An attorney helps your case by helping you understand your rights and options throughout the process. Reach out to us at Ozment Law for legal guidance.